Australia’s financial markets are distinguished not only by their dynamic trading activities but also by a robust regulatory framework that ensures market integrity and investor confidence. Central to this framework are the roles played by the Australian Securities Exchange (ASX) and various regulatory bodies such as the Australian Securities and Investments Commission (ASIC) and the Reserve Bank of Australia (RBA).

Market Supervision by ASX and ASIC

ASX Compliance Function:

The ASX plays a pivotal role in ensuring the smooth operation of Australia’s share market through its Compliance function. This involves overseeing the adherence to ASX listing and operating rules by listed entities and market participants. The integrity of market operations is crucial, and the ASX’s proactive measures help maintain a fair and transparent trading environment.

ASIC’s Regulatory Oversight:

Further reinforcing confidence in the market is the regulatory role undertaken by ASIC. This national regulator oversees all trading venues, clearing, and settlement facilities across Australia. ASIC’s supervision extends to ensuring that the ASX itself adheres to its obligations as a listed public company. This multi-layered oversight is vital in maintaining the operational integrity of the financial markets.

Reserve Bank of Australia’s Role:

In addition to ASIC, the Reserve Bank of Australia plays a crucial part in overseeing the stability of the financial system. The RBA’s oversight ensures that the broader financial environment remains stable and conducive to healthy market operations.

Tiger Brokers: Facilitating Access to Australian Share Trading

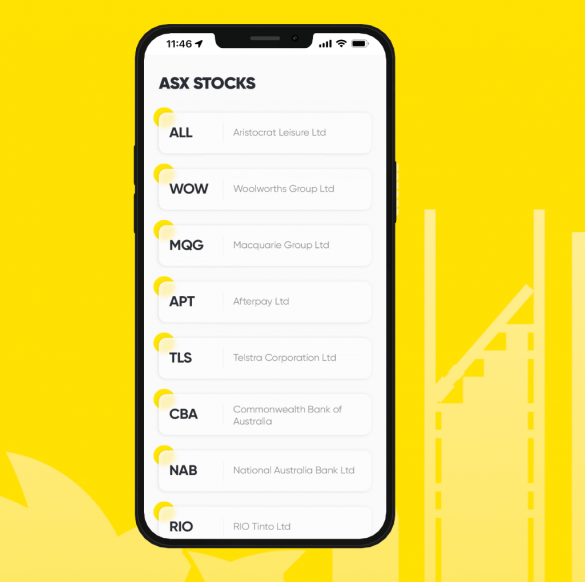

For investors interested in tapping into the opportunities provided by the ASX, platforms like Tiger Brokers offer a valuable gateway. Tiger Brokers provides an Australian share trading service that enables investors to engage with the Australian share market efficiently.

Key Features of Tiger Brokers:

– Access to ASX Trading: Tiger Brokers users can trade a variety of asset classes available on the ASX, taking advantage of the diverse investment opportunities it presents.

– Technologically Advanced Platform: Tiger Brokers leverages cutting-edge technology to provide a seamless trading experience, making it accessible for both novice and seasoned investors.

– Regulatory Compliance: By operating in compliance with local regulations, Tiger Brokers ensures that its services are secure and reliable, aligning with the overarching principles of market integrity upheld by ASX and ASIC.

Conclusion

The Australian share market is characterized by its robust regulatory framework, designed to ensure fair trading practices and protect investor interests. With the oversight provided by bodies like ASX, ASIC, and the RBA, investors can participate in the market with confidence. Platforms like Tiger Brokers enhance this experience by offering user-friendly and compliant access to ASX trading, making it easier for investors to explore and invest in the Australian financial markets. While this article does not provide investment advice, understanding the regulatory environment and the tools available is essential for anyone looking to navigate the complexities of share trading in Australia.